Real estate is still one of the most popular ways to invest money because it not only provides you with monthly passive income but also the long-term appreciation of the property. So, double earnings! However, it has become more difficult in recent years to find investment properties with good returns due to the rising housing market and recently increasing mortgage rates. Nevertheless, there are still some specific real estate opportunities that remain very profitable, such as buying a student house!

In this article, we delve deeper into buying a student residence or room rental property. We discuss the advantages of a student residence as an investment, several important points specific to buying a student house, where you can find them, and we also look in detail at an attractive room rental property for sale in Delft on BRXS.

Table of Contents:

- 2 Major advantages of buying a student house.

- 6 Important points to consider when buying a student residence

- How and where to find a student house for sale?

- Room rental property for sale in Delft

Advantages of buying a student house:

Buying a student residence offers the same advantages as investing in real estate in general: stable and relatively safe, lower volatility than the stock market (and crypto), portfolio diversification, inflation protection, and leverage through loans. However, there are two additional advantages that currently make student residences an even more attractive investment.

Much higher rental yield

Rental yield is simply expressed as the rent you receive annually from your tenants as a percentage of your investment. Example: You receive €6,000 in net rent per year (after all your costs such as mortgage interest and maintenance) and you have put €100,000 of your own money into the property, then your net rental yield is 6%.

Because house prices have risen sharply in recent years (sometimes even by more than 10% per year) while rental prices have risen less, the rental yield has decreased. This makes sense because you have to invest more but don’t get proportionally as much rent in return. This has made it harder to find investment properties that still offer a good rental yield, leading many real estate investors to focus more on value appreciation. However, specific sectors still provide good returns, such as student houses and room rental properties.

An example of a 100m² apartment in Amsterdam to show the difference:

- Suppose you rent the property entirely to one tenant, the rent is about €2,450 per month (based on the average rent per m² in Amsterdam in 2022).

- Suppose the property is divided into 5 rooms (14 m² per room) + Kitchen and common area (16 m²) and 2 bathrooms (12 m²), and you rent to 5 different people, then you get €3,750 per month (based on rental prices on Kamernet).

€2,450 vs €3,750 per month, a difference of about 50%, and annually you earn €15,600 more in this example if your investment property is divided into rooms. And so you immediately see why room rental properties are so popular with investors. You do need to consider that a student house incurs slightly more costs (which we discuss below in the article), but even then, you still have significantly more return.

Increasing shortage of student rooms

Preliminary estimates from the Knowledge Centre for Student Housing (Kences) show that the shortage of student rooms in the Netherlands continues to grow. Last year, there was a shortage of 26,500 student homes, and this could increase to over 60,000 in the coming years if no solutions are found. It’s even so bad that universities across the country are advising foreign students not to come to the Netherlands if they haven’t found housing yet.

Hopefully, solutions will soon emerge to address these structural problems so that the number of student houses can increase, as attracting foreign students and talent has a strong positive impact on our economy. But it does show that the risk of vacancy (not finding tenants or difficulty finding them) is very low when investing in a student house.

Important points to consider:

A higher return is certainly a serious plus for student residences, but there are several things you need to consider. Buying and renting out a student house involves more than buying and renting out a regular house to one person or a family, such as higher costs and stricter regulations.

1. Higher management costs

Instead of one tenant, you have multiple for the same property. So, you also have more work managing the property: you need to find more tenants, conduct more viewings, handle more contracts, more check-ins and check-outs, more communication,… You can do all this yourself, but it will take a lot of time and you might make some mistakes. A professional property manager can help with their experience and network, but it can cost something, and they will also charge a higher commission if there are multiple tenants per property. You should expect around 10% of the rent.

2. Higher maintenance costs

Besides higher management costs, maintenance will also be slightly higher because multiple tenants in the same property will cause more wear and tear and general damage than one person or a family. Often, room rental is also short-term. In the case of students, usually 1 year or sometimes 2. This means you will need to repaint and replace furniture much more often.

3. Finding tenants

As indicated above, there is a shortage of student rooms, so it shouldn’t be too difficult to find tenants quickly. However, it is advisable to build a good relationship with the University and local student associations, which often have waiting lists, so you can quickly find reliable tenants without even having to list online.

4. Permits and regulations

When purchasing a room rental property, there are much stricter regulations than when buying a house for rental. So definitely do not buy a property hoping to convert it into a student residence without first conducting thorough research into local regulations, permit requirements, and other rules.

What you should definitely check:

- Regulations regarding room rental are at the municipal level and can vary greatly from city to city. For example, in The Hague, the maximum number of people per property is 3, regardless of the property size, while in other cities you can rent to 8 or more people.

- Almost everywhere, you need to apply for a specific permit for room rental, and there is also a quota on the maximum number of permits per neighborhood or city. For example, in Amsterdam, this quota has already been reached in many neighborhoods, making it impossible to convert new homes into room rentals. Also in Delft, permits are hardly issued anymore.

- To obtain and maintain a permit, the property must also meet many strict requirements:

- There are often requirements regarding the minimum area of the property, the size of the common area, and even the number of bathrooms per person.

- Fire safety must be fully in order, and a report must be made to the environmental agency (omgevingsloket).

- Floors and walls must be sufficiently insulated and meet noise requirements according to NEN 5077.

5. Investment mortgage

If you buy a student residence for rental, you can also finance it with a mortgage. This is different from a mortgage for a house you plan to live in. Many Dutch banks and lenders offer these, but keep the following in mind:

- They don’t look at your annual income or salary, but at the rental income of the property. The mortgage provider wants to know if the interest can be comfortably paid from the rent received each month.

- The provider will also conduct a thorough analysis to check if you have the correct permit and what the current market value of the property is in rented condition via an appraisal report. This “rented” market value is often lower than the purchase price.

- There is a maximum loan amount that is lower than what you would expect with a regular mortgage, often around 70%. Although some providers go up to 80% or slightly more, this usually comes with a higher interest rate.

- Interest rates for an investment mortgage are higher than those for a traditional mortgage and currently (September 2022) fluctuate between 4.5% and 6%, depending on the provider and the loan-to-value ratio.

6. Renovations

When you purchase a regular home and want to convert it into room rentals, significant renovations are often needed to optimize the return. Renovations often serve to meet permit requirements, but also to increase the number of individual rooms and make the property attractive to renters with sufficient bathrooms, toilets, and a kitchen and common area adapted for use by multiple people. This should definitely not be underestimated, and it’s best to use a good architect to ensure everything complies with regulations and zoning plans.

How to find a student house?

There are two ways to invest in a room rental property or student residence:

- You do everything yourself by purchasing a property in a suitable neighborhood (read: close to a university), renovate it, apply for a permit, and rent it out to students.

- You buy an existing investment property with a room rental permit from another real estate investor.

The first method is usually the one where you, as an investor, will make the most profit, but it comes with much more risk and a lot more work. Also, it is currently quite difficult to obtain new room rental permits because municipalities are trying to limit nuisance in neighborhoods and have introduced quotas for the maximum number of permits. Especially for the coming years, this method seems difficult to achieve, but who knows, you might find an opportunity somewhere.

The second method carries significantly less risk: the permit has already been issued, the property is often already rented out, you have a clear view of the current rental income and thus your expected future return, and often no major renovations are needed immediately. Now, you will rarely find these opportunities just listed on Funda and will need to search on various specific marketplaces for investment properties. Unfortunately, attractive student houses are often not even offered there because they are frequently sold off-market earlier. Therefore, it’s good to contact various real estate agents specializing in investment properties, student houses, and room rental properties. This way, you build a network, and if these connections are aware of student houses for sale, they will keep you informed.

What if you only want to buy a student room, not a whole student house?

Very interesting idea! Especially if, like so many of us, you don’t have enough personal funds to buy an entire student house. But unfortunately, this is not possible because a room does not have its own house number, its own bathroom, toilet, and kitchen, and therefore cannot be sold or rented independently.

Fortunately, BRXS is an option for you. Through the platform, you can invest directly in investment properties of your choice (starting from €100), earn your share of the rental income, benefit from long-term value appreciation, and track your investment closely as if you were the landlord yourself. BRXS regularly features student residences and room rental properties, often acquired off-market. Like this room rental property in Delft analyzed in more detail. You can create a free BRXS account here.

Unique student house for sale in Delft

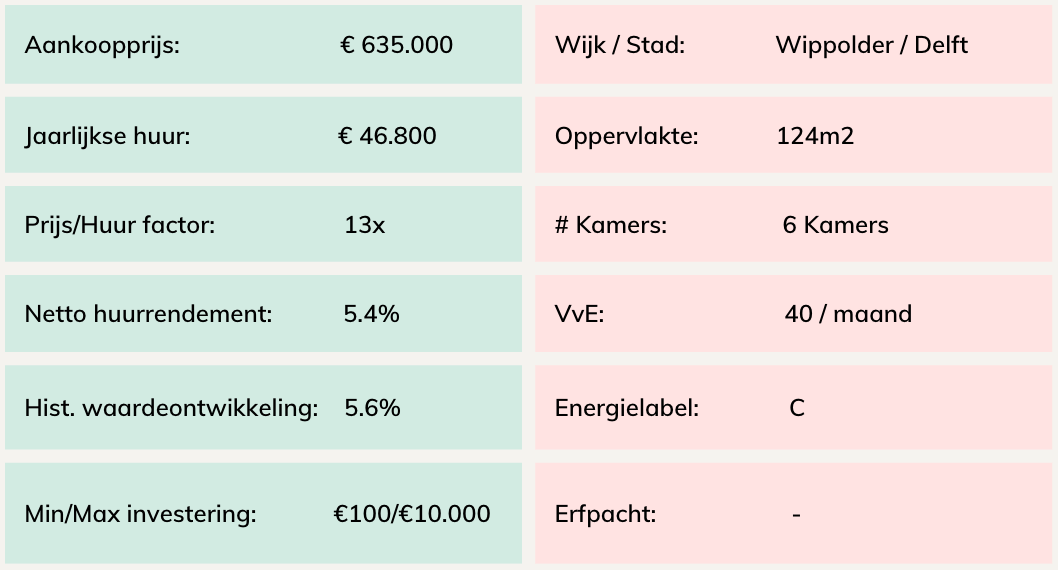

As promised, we also offer you an exclusive look at a fully licensed room rental property with 6 rooms in the center of Delft, currently offered on the BRXS platform, where you can invest starting from €100.

Here you can find more information and invest. If you don’t have an account with BRXS yet, you must first create a free account.

Student residence for sale near TU Delft

Student residence for sale near TU Delft

What are the unique plus points of this investment:

- An expected net return of 5.4% on rent alone, thus a good way to protect your savings against inflation.

- Located in the center of Delft in a popular neighborhood next to TU Delft with low vacancy risk due to a rising student room shortage. The room rental property has experienced 0% vacancy in the last 7 years.

- The property is already fully rented out, so you earn rental income from day one.

- Fully renovated in 2022 for over €80,000, so little maintenance is expected for the coming years.

The key numbers:

Key facts - Delft student residence for sale

Key facts - Delft student residence for sale

What return can you expect?

With an investment in a room rental property on the BRXS platform, you earn in two ways, just like if you were investing directly in a property yourself: 1) Rental income distributed among all investors (proportional to their investment in the property) 2) Future value appreciation.

We can estimate the net rent based on the current rental contract (€3,900) and estimates of costs based on the past. This results in an expected net rent of €3,243 per month or an annual rental yield of approx. 5.4%. In other words: if you invest €1,000 in this room rental property, you can expect a rental income of €54 for the first year (BRXS deposits this into your account every three months). More financial details about the property.

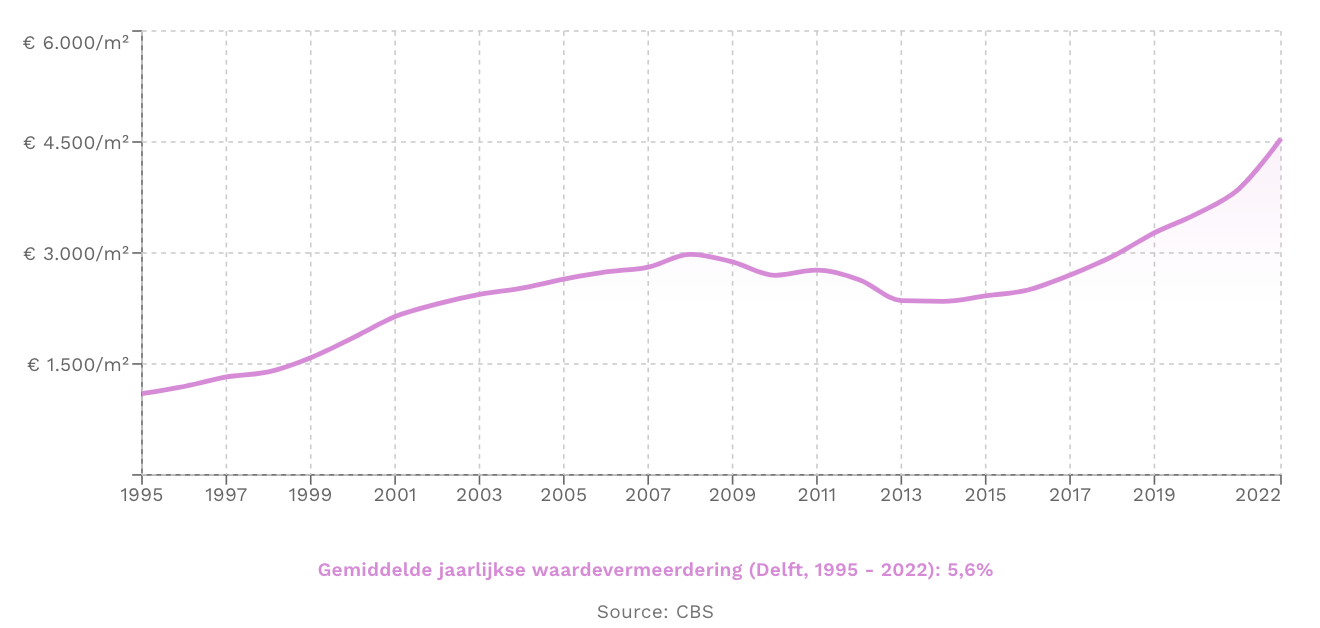

Of course, we cannot predict future value appreciation. Looking at the past, the housing market in Delft has shown strong appreciation over the last 25 years: house prices increased on average by 5.6% per year between 1995 and 2022. Real estate is often more stable than the stock market, but it’s still important to emphasize that prices do not rise equally strongly every year, and there are also periods of several years with price declines.

Virtual tour of the student house for sale

Unfortunately, you cannot visit the student house yourself, but we do our best with a short description and some photos.

Description of the student house for sale

The room rental property consists of three floors totaling 124 m² GFA (according to the NEN-2580 measurement) and features 6 rented rooms, a shared living room, a new fully equipped kitchen, two showers, two toilets, and a balcony. In 2022, the apartment was fully renovated for over €85,000 and equipped with new furniture and appliances. Among other things, new (insulation and PVC) floors were installed, the paintwork was done, and investments were made in a new kitchen and bathrooms. Furthermore, the student residence for sale has a permit and meets the necessary noise requirements and fire safety standards.

-> More photos can be found here

Location of the student house for sale

The apartment is located in the Wippolder district in Delft near TU Delft, which is within walking distance. The student house is also close to the center, restaurants, shops, and supermarkets. Delft station can be easily reached within 5 minutes by bike. This location makes it very attractive for students and young professionals to live here.

How to start with BRXS?

BRXS makes investing in real estate accessible, easy, and affordable. As a BRXS user, you can invest directly in rental properties offered on the platform starting from €100. And thus easily diversify your portfolio with real estate, earn passive income from rent (paid out quarterly), and also share in future value appreciation.

More information about the student house for sale in Delft can be found here and you can also invest. However, you must have a free account before you have access. If you don’t have one yet, you can register here, which only takes a few minutes.

Do you have any more questions about how BRXS works? We are always here to help. You can easily schedule a call with us, start a chat, or send us an email at hello@brxs.com.