Buying a house to rent out is a very popular way to invest because it generates monthly passive income from rent, which you can earn for a long time. On top of that, there’s the appreciation of your property with the growth of house prices. It’s also nothing new: real estate has been bought and rented out for hundreds of years. That also makes it reliable, unlike more “trendy” investments like crypto and NFTs. Furthermore, there are many other advantages to buying a house for rent.

However, buying and renting out a house is not as simple and accessible as investing in stocks on the stock market. To start yourself, you need enough capital, free time, and patience, and don’t forget all the work involved: renovations, finding tenants, regular maintenance, problems with tenants, etc. That’s why we started BRXS: a platform where you can directly invest in investment properties of your choice starting from €100 and build your (dream) real estate portfolio.

In this blog, we focus on everything you need to know and think about if you want to buy and rent out a house yourself. And of course, we start with the return, because why else would you start if it doesn’t yield anything:

- Return on buying and renting out a house

- Is it allowed to buy a house for rental?

- Investment mortgage: How to finance your purchase

- Risks when buying and renting out a house

- 4 Important tips when buying a house to rent out

How profitable is buying a house for rent?

When you buy a house for rent, you can count on two different forms of return: Firstly, you have the monthly income (minus all additional monthly costs) that you get from the rent, and on top of that, you also benefit from the potential appreciation of your property.

Both returns are independent of each other, providing good diversification. For example, if house prices do not perform well for a few years, you can still achieve a very good return thanks to your rental income.

Both are also very different in nature: rental income can be seen as passive income, a fixed amount deposited into your account each month, while appreciation is a potential profit that you only realize when you sell your rental property.

Rental Income

Before proceeding to buy a house for rent, it is important to make a good calculation, see if it is profitable, and what return you can expect. The last thing you want is a negative return, meaning you pay more in fixed costs monthly than the actual rental income.

So always map out all costs and benefits and see how much net income you have left monthly after deducting all costs from the expected rental price. Some costs like city taxes or VvE contributions may not apply, and others like property management are your choice. You can also manage your investment property entirely yourself and find tenants.

How to calculate your real estate return?

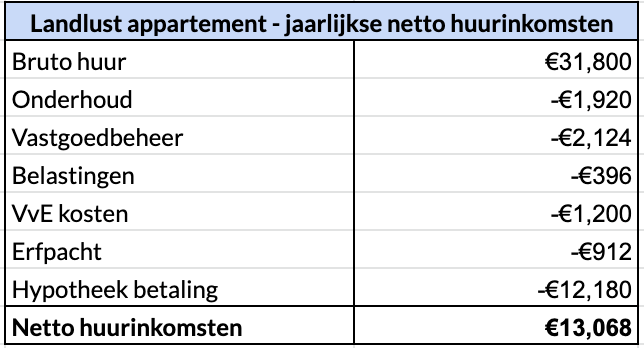

We do this using a current example, namely one of the investment properties on our platform (Landlust - Amsterdam) with current rental income and purchase costs.

Annual net rental income:

The calculation shows how much money remains from the rental income after deducting all costs. To convert this into a return, we compare this net income with the total amount invested in the property.

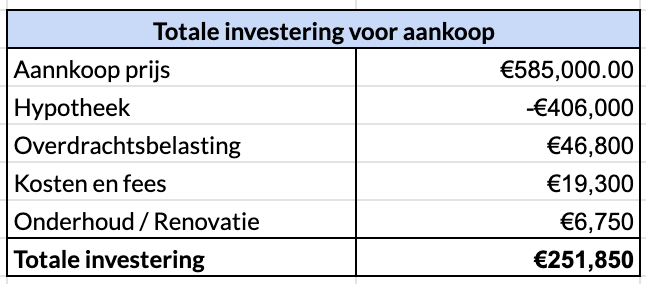

Total invested amount:

This results in a net annual rental yield of 5.2% (= 13,068 / 251,850).

What is a good net rental yield?

It’s important first to differentiate between Gross and Net, because in many places you will often encounter gross yield, which can be much higher and often leads to confusion. The gross yield calculation considers the gross rent (before cost deduction) and the equity in the apartment (excluding transfer tax and other costs). In the example above, this would be 17%. Which seems great but doesn’t reflect the full reality. To avoid nasty surprises, always calculate the net yield including all costs.

A good net rental yield strongly depends on the location. For example, in a large city like Amsterdam, a good yield might already be between 3-4%, whereas a yield in a smaller municipality like Emmen is only good starting from 6%. Of course, it’s about more than just yield; risk also plays a major role: buying and renting out a house in a city like Amsterdam with a strong rental market and rapidly growing population carries less uncertainty for the future than buying a house to rent out in a smaller municipality.

With the investment properties we offer on the BRXS platform, we strive for a good balance between strong rental yield, potential for appreciation, and locations in cities with a strong long-term rental market.

Value Appreciation

While you can estimate the rental yield somewhat accurately, future value appreciation is not something you can determine with certainty. It’s good to remain conservative and not have overly high expectations.

However, when buying a house to rent out, you can partially finance it with a mortgage, which provides a significant advantage: the leverage effect! This means that thanks to the mortgage, your return will be higher because your equity in the property is smaller.

Let’s illustrate the leverage effect with a simple example:

Suppose you purchase an apartment for €400K with a mortgage of €320K and an equity contribution of €80K. If the investment property appreciates by 5% the following year, it is now worth €420K, an increase of €20K. This €20K represents an actual increase of 25% on your €80K own investment. This is therefore a much better return on your investment than the 5% if you had purchased the apartment entirely with your own capital.

What value appreciation can you expect?

As already indicated, predicting the future is impossible, but let’s look at the past out of curiosity. We do this over the long term to reduce the effect of overheating (periods of very rapid increases) and crashes (periods of very rapid declines).

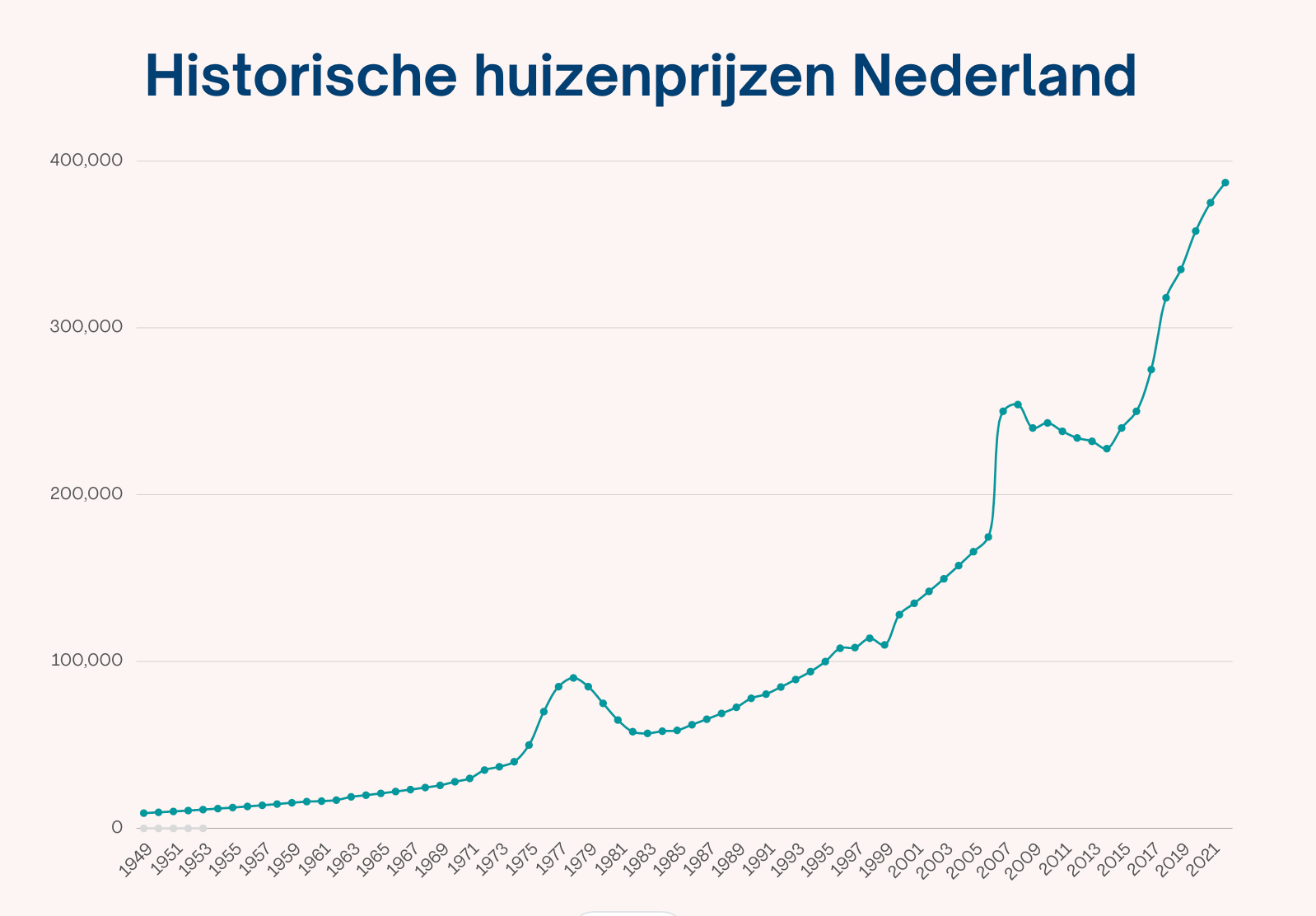

House prices in the Netherlands have increased over the last 70 years with an average rise of 5.4% per year. In 1949, the average price of a home was €9,199, and today it stands at €387,000.

The housing market is less volatile than the stock market, yet price increases and decreases vary from year to year. The graph above shows serious declines in the periods 1978-1983 and 2008-2013. The good news is that every decline was followed by a recovery, and house prices show an upward trend in the long run.

Is buying and renting out a house allowed?

Yes, it certainly is! However, there are a few things to consider, and it’s also good to check with each municipality about any additional requirements:

Free Sector Rent:

A house or apartment for rent can fall under either social housing or the free sector, and this can have a huge impact on your return.

- With social housing, the basic rent (rent excluding service costs) cannot exceed the liberalization limit, which was €763.47 in 2022.

- With a free sector property, also sometimes called a liberalized rental property, there is no maximum allowed rent or maximum annual rent increase. As a landlord, you can determine the rental price of your investment property yourself.

You don’t choose whether your apartment or house is considered social or liberalized; this is determined by a points system. Your apartment gets points based on various criteria: surface area, WOZ value,… and if it scores below 142 points, your property is considered social housing.

When buying a house for rent, it is therefore very important to do the points count. You don’t want to find out afterwards that your expected rent is much lower than you calculated.

Owner-Occupancy Obligation and Buyout Protection:

Some cities and municipalities enforce an owner-occupancy obligation, meaning that if you buy certain properties, you as the buyer are required to live in the property yourself for a number of years. In other words: you cannot simply buy a house to rent it out.

The owner-occupancy obligation and specific criteria vary from city to city. For example: in Amsterdam, this currently only applies to properties purchased after April 1, 2022, with a WOZ value below €512,000.

Transfer Tax:

If you buy real estate in the Netherlands, you must pay transfer tax at the time of purchase. For a home you will live in, this transfer tax is 2% of the purchase price, but for other purposes such as holiday homes, investment properties, and commercial properties, it is 8%.

Taxes on Rent:

In the Netherlands, you do not pay taxes on the rental of your second home, and your rental income does not need to be declared. However, your investment property(s) do belong to your box 3 assets, on which you pay taxes.

Investment Mortgage: How to finance your purchase

When buying a house to rent out, you can partially finance it with a mortgage. And as explained above, this also has a positive effect on your return (Leverage effect).

A mortgage for an investment property is different from the “regular” mortgage for a house you will live in and is usually called an investment, buy-to-let, or rental mortgage. Many banks and mortgage lenders in the Netherlands offer these, but keep the following in mind:

How much money do you need?

The maximum financing is often 70% of the market value of the property in rented condition (some lenders offer options up to 90%, but be aware that the mortgage costs may be higher). This market value is often lower than the purchase price, and you must definitely take this into account when calculating your own contribution.

A brief example: Suppose you buy an apartment for rent for €400,000, whose value in rented condition is €350,000. With 70% financing, you get a mortgage of €245,000. You then still need to contribute at least €187,000 yourself for the remaining amount and the transfer tax (8%), and this does not yet include other costs such as notary and real estate agent fees.

So, it might well be that you need quite a lot of personal funds available to purchase an investment property. (In our other blog, we also discuss options for investing in real estate with little money)

What mortgage interest rate can you expect?

You also pay more interest on an investment mortgage than on a regular mortgage. This rate depends on the loan amount: for a mortgage of 70% LTV (Loan-to-Value), you pay more than for one of 50% LTV. The rate varies from bank to bank; especially in the current market, you can expect somewhere around 3.5-4.5%.

What are the risks when investing in a house to rent out?

Despite real estate being seen as a relatively safe investment, like all investments, there are risks you need to consider:

Maintenance Costs:

Unexpected maintenance work can always arise that costs much more than anticipated. This cannot be ruled out, so try to get a good technical inspection done before purchase to avoid surprises as much as possible.

Vacancy:

Consider the stability and strength of the rental market where you want to buy an investment property, because if you can’t find a tenant for a longer period, your costs like mortgage payments will continue.

Non-paying Tenants:

It’s certainly not the norm, but there is always the risk that your tenant can no longer or will no longer pay their rent. Then you must start legal proceedings to terminate the lease agreement and evict the tenant. This can cost a lot of time, money, and frustration.

Housing Market:

House prices have seen sharp increases in recent years due to increasing demand amid a structural shortage of housing supply. But the past offers no certainty for the future, and there have been several periods in the last 70 years when house prices fell.

4 Important tips when buying a house for rent

Spread your investments:

The golden rule of investing is not to put all your eggs in one basket, and this also applies to real estate. Because if something goes wrong, it immediately impacts your entire investment. So it’s better to spread your risk and not be exposed to just one or a few investments.

This is easier said than done because buying a house for rent often requires a large investment. But if you’re not ready for that yet, there are also ways to start in real estate with less money.

Homes are not crypto:

Real estate investing is not suitable for short-term speculation. If you get into it, try to do so for the long term to optimize your return and also avoid having to sell at a time when house prices have fallen. So invest with money you can afford to lose and won’t need soon.

Thorough research:

Conduct thorough research before purchasing a property: calculate the expected return, analyze the local rental market, create a financing plan, confirm that your property falls into the free sector and is not subject to an owner-occupancy obligation,… It might cost something, but seeking good advice from experts is certainly not an unnecessary luxury.

Property management:

Hiring a property manager might not seem cheap at first glance (7-10% of gross rental income), but it can save you a lot of pain and stress. They know the local market very well, help with selecting reliable tenants, and can save you a lot of time and effort.

Conclusion

Buying and renting out a house remains a great way to generate passive income, but so much is involved. If you want to benefit from investing in real estate but don’t feel like figuring everything out yourself, managing it, and financing it, there’s another way. Let BRXS take all the work off your hands while you only