The BRXS platform offers a unique investment opportunity: a licensed room rental property for sale in the center of Delft that is already fully rented out and has a very strong rental yield.

With BRXS, you can invest directly in investment properties starting from €100, earn your share of the rental income, also benefit from long-term value appreciation, and build a real estate portfolio your way. You can find this student house for sale in Delft here on the platform. If you don’t have a BRXS account yet, you first need to create a free account before accessing the platform.

Brief summary of this student house for sale:

- Good inflation protection with an expected net yield of 5.4% on rent alone.

- Popular neighborhood near the Delft University of Technology with low vacancy risk due to increasing student room shortage (0% vacancy in the last 7 years).

- Already fully rented out.

- Fully renovated in 2022 for over €85,000, so little maintenance expected for the coming years.

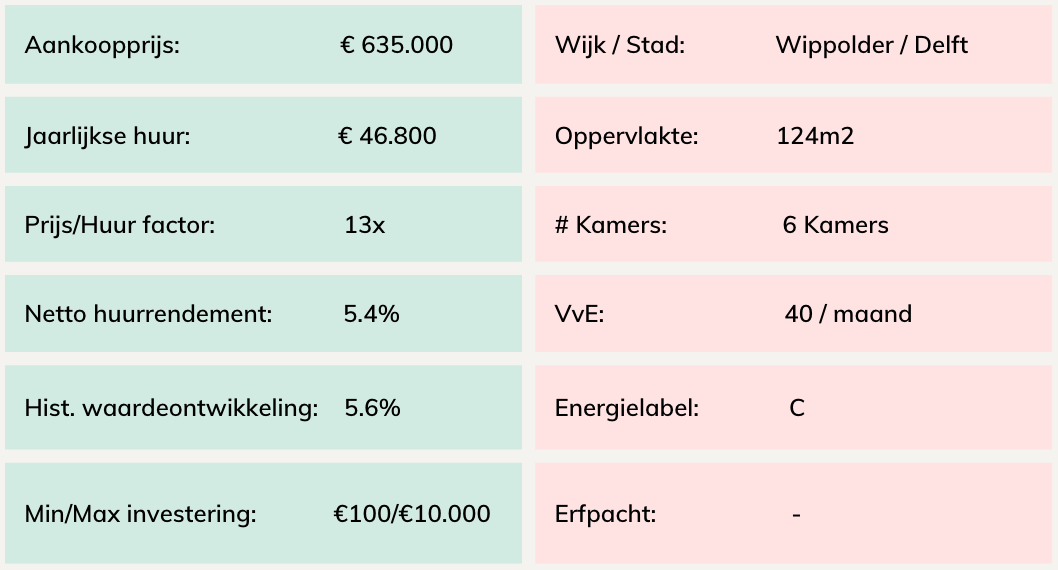

Key data:

Key data for room rental property for sale in Delft

Key data for room rental property for sale in Delft

The return on this student house for sale

Just like when you buy an investment property directly yourself, with BRXS you earn in two ways: 1) Rental income distributed among all investors proportional to their investment in the room rental property 2) Value appreciation over the longer term.

Expected rental return

Very simple: The gross rent we receive from the tenants is fixed at €3,900 per month. Then we expect some costs such as maintenance, insurance, VVE contributions, management fees, and city taxes. You can find the exact estimate in the following table:

This results in an estimated monthly net rent of €3,243 or an annual return of approximately 5.4%. So, if you invest €1,000 in this student house, you can expect a rental income of €54 for the first year, deposited into your account every three months. More rental details about the property.

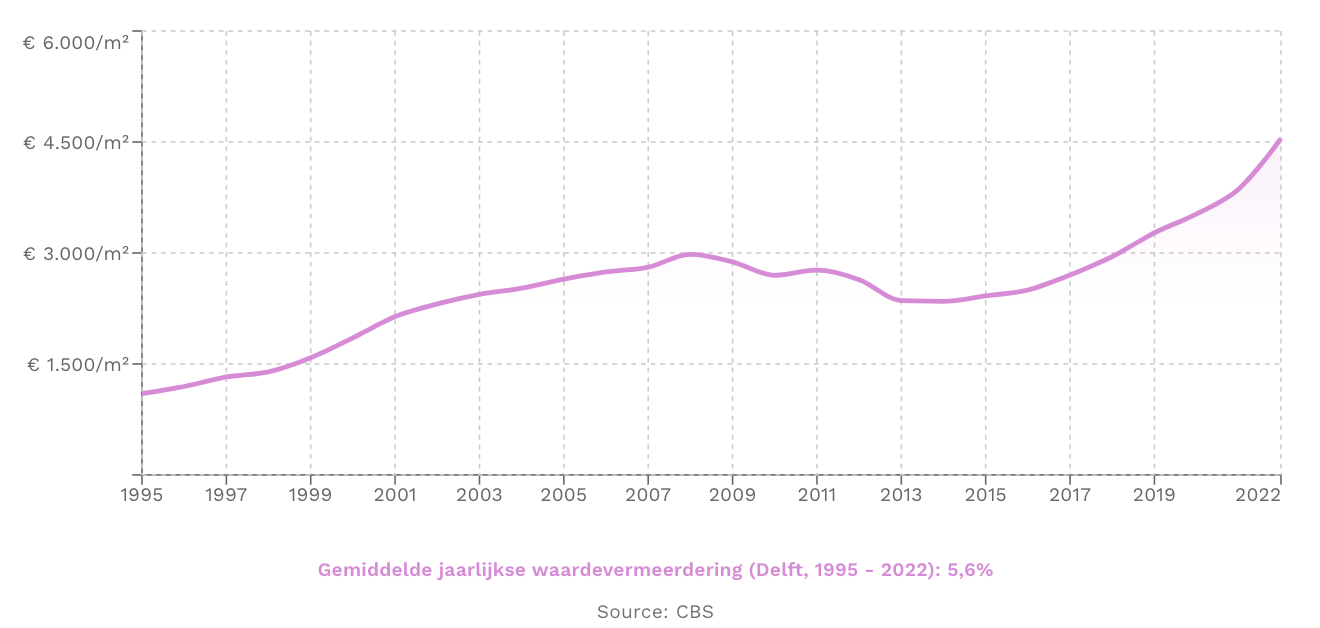

Historical value development in Delft

You can estimate the rental return relatively well, but what the housing market will do in the next 10 years is something nobody knows exactly.

Let’s look at the historical housing market in Delft: Between 1995 and 2022, house prices in Delft increased by an average of 5.6% per year over the entire period, including a period of value declines in 2008-2013.

Average annual value development in Delft between 1995 and 2022

Average annual value development in Delft between 1995 and 2022

If you look at the long term, the housing market has shown a strong return and is also more stable than the stock market, yet prices do not rise equally strongly every year, and there are also years with price declines. You can read more about the current housing market and forecasts here and it’s also important to emphasize that past results offer no guarantee for the future.

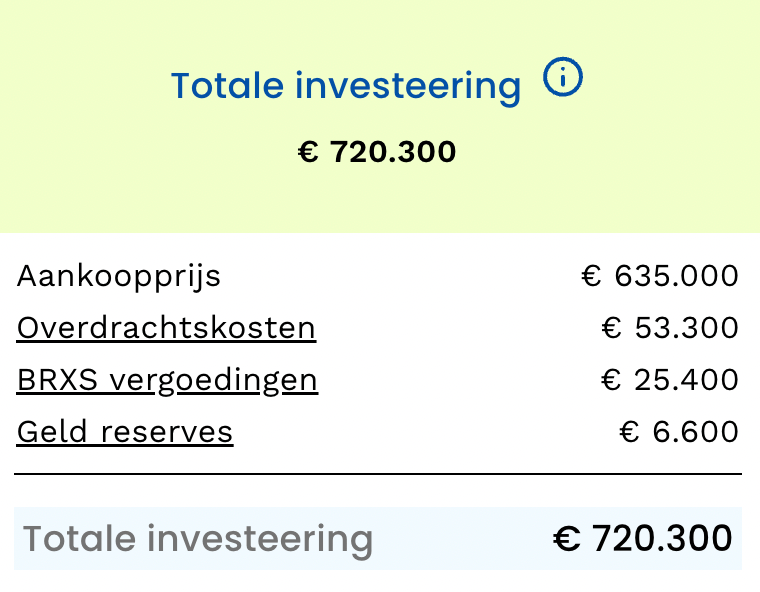

The total investment in this room rental property

Where does the investors’ money go? When purchasing the property, there’s more involved than just the purchase price. Taxes must be paid (i.e., transfer tax), notary fees, the BRXS fee, and a cash reserve set aside for the room rental property.

Investment in the student house for sale

Investment in the student house for sale

- Purchase price: The price at which the room rental property for sale was purchased.

- Renovations: The cost of all repairs needed to prepare the investment property for rental. In this case, no repairs are needed because the student house was just renovated for over €80,000 and is therefore in very good condition.

- Transfer costs: All costs associated with purchasing a property, such as transfer tax (8% for investment properties) and notary fees.

- BRXS fee: A one-time fee for BRXS covering all efforts involved in acquiring the investment property, such as the search, investigation, purchase, and preparation of the property.

- Cash reserves: These serve as a buffer for potential unexpected events such as emergency repairs or vacancies. We hope, of course, that we won’t need these reserves, but it’s better to be prepared for everything, allowing the investment to withstand setbacks. When a property is eventually sold again, the cash reserves, along with the net proceeds from the sale, are distributed among all investors.

Virtual tour of the room rental property

The room rental property is already fully rented and occupied, making it impossible to schedule viewings for everyone interested in investing. However, we do our best to provide a complete picture with the descriptions, photos, and floor plan below.

The student house for sale

The student residence consists of three floors totaling 124 m² GFA (according to the NEN-2580 measurement) and features six rented rooms, a shared living room, new kitchen, two bathrooms, two toilets, and a balcony. The property was fully renovated in 2022 for over €80,000 and equipped with new furniture and appliances: including new (insulation and PVC) floors installed, interior and exterior painting done, and investments made in a new kitchen and bathroom. Furthermore, the room rental property for sale has a permit and meets the necessary noise requirements and fire safety standards.

For this student residence, we collaborate via a multi-year agreement with a local company that partners with TU Delft, among others, for housing international students. TU Delft reserves this student residence each year for the arrival of new international students, guaranteeing the occupancy rate for the coming years. Furthermore, this company has partnerships with institutions including The Hague University of Applied Sciences, Leiden University (with a faculty in The Hague), Erasmus University Rotterdam, Rotterdam School of Management, Rotterdam University College, Codarts, and Webster University. These educational institutions refer international students to the partner’s platform where they can form groups to rent a student house. This leads to a large annual influx of new young internationals. This is also why this student house has managed to achieve a 100% occupancy rate over the past 7 years. The partner has completed approximately 1,500 rental transactions to date. The six rooms and common areas are rented for a fixed term to international students. The current annual rental income is €46,800.

Location and surroundings

The room rental property for sale is located in the Wippolder district in Delft, close to various faculties of the Delft University of Technology, which are within walking distance. The property is also near the city center, hospitality and shopping facilities, and supermarkets, all within walking distance. Furthermore, Delft station can be reached in about 5 minutes by bike. This location makes it very attractive for (international) students / young professionals to live here.

Wippolder

Wippolder

TU Delft

TU Delft

How does BRXS work?

BRXS is an investment platform that makes investing in real estate accessible, easy, and affordable. BRXS users can invest directly in the investment properties offered on the platform starting from €100. This allows you to easily diversify your portfolio with real estate, earn passive income from rental proceeds (paid out quarterly), and also share in the long-term value appreciation.

Build your real estate portfolio and let your money work for you with complete transparency, without worrying about managing an investment property yourself and finding tenants.

You can find the above student house for sale in Delft here. You must first create a free account before accessing the platform. Note: Opening and maintaining a BRXS account is 100% free and only takes a few minutes.

How to start with your first investment on the BRXS platform?

Step 1: Create a free account If you don’t have an account yet, you can create one here. Currently, only Dutch residents are allowed to invest via BRXS.

Step 2: Browse through the investments on our platform View the different investment properties and discover which ones you want to invest in. Like the student house discussed above, all properties on our platform have already been purchased by BRXS, and are therefore fully available and ready as investments. They are not dependent on raising financing.

Step 3: View the investment properties that interest you Once you click on a specific property, you get all the important information: Photos, location, market value, size and current rental status, historical appreciation, full financial overview with expected rental income. There is also a calculator to estimate your expected return based on your investment amount, expected period, and your assumptions about value appreciation.

Step 4: Invest in what you want Once you’ve made a choice, you can easily make an investment by clicking “invest now”. Then you choose the number of BRXS notes, where one BRXS note corresponds to an investment of 100 euros in the property.

- You can invest starting from 100 euros, but you cannot invest more than 10,000 euros per property.

- You can make your payment using iDeal.

Step 5: Track your investments directly in your portfolio and receive payments every quarter Once invested, you can track all your investments transparently in your portfolio and earn in two ways: rental income payments (paid out quarterly) and potential long-term value appreciation.

Do you have any more questions about how BRXS works? We’re here to help. You can easily schedule a call with us, start a chat, or send us an email at hello@brxs.com.

Here are answers to the most frequently asked questions:

What return can you expect?

The return on your investment consists of net rental income (paid quarterly) and potential long-term value appreciation. On each property page, you’ll find all financial info and a tool to get a better estimate of your expected return. Read more.

What do you actually buy when you purchase a BRXS note?

When you buy a BRXS note, you purchase a bond that gives you the right to a quarterly interest payment and the repayment of your investment amount after costs. This payment is variable and depends on the proceeds of the property to which the BRXS note relates and consists of:

- Net rental income: Total rental income minus all costs such as maintenance, municipal taxes, insurance, and mortgage interest payments.

- Value appreciation: You receive your share of the potential capital gain made when the property is sold.

When and how can I sell my BRXS notes?

We created BRXS for investors looking to invest in real estate long-term (at least several years) for optimal returns. BRXS plans to hold each room rental property for about 10 years and will sell it when financially opportune for investors. If necessary, there are options available if you wish to sell earlier. Read more.

How does BRXS make money?

Opening and maintaining a BRXS account is free. BRXS earns money through a fee included in the investment amount, a property management fee automatically deducted from gross rental proceeds, and transaction fees on the purchase/sale of BRXS notes. All displayed estimated returns are net after all BRXS fees. Read more.

What if BRXS goes bankrupt or can no longer operate?

When you invest in a room rental property, you invest not in BRXS but in an entity (BV) that owns the specific property. So, if BRXS can no longer manage the student residence, it will be sold, and the proceeds will be distributed among all investors in that property after mortgage repayment. Read more.

What risks are involved?

As with all investments, real estate also involves risks you should consider, such as vacancy, non-paying tenants, maintenance issues, and housing market fluctuations. Read more

Who owns the student residence?

Each investment property is fully owned by a specific subsidiary of BRXS BV (e.g., BRXS Lucellestraat BV). Therefore, you are not legally the owner of or liable for the property concerning the BRXS notes you purchase. Read more

More questions?

Read our full FAQs here.