Today, there are various ways to invest your money, from stocks and bonds to crypto, NFTs, and gold. So why invest in real estate? Real estate investing offers many advantages such as portfolio diversification, inflation protection, more stable income… It’s also nothing new: real estate investing has been done for decades, which also makes it reliable.

But what return can you expect? How do you calculate the return on real estate? And how does it compare to other types of investments? We will delve deeper into this here and also provide a sample calculation using one of the investment properties on our platform.

What does real estate return consist of?

When you invest in an investment property, you can expect two types of returns:

- Monthly net rent: total rent received minus all monthly costs

- Growth in house prices: the development of the value of your property over the long term

Both are also very different: rent can be seen as passive income, a fixed amount received each month, while value appreciation is a profit realised only at the end when selling your property.

Both are independent of each other, which provides good diversification. For example, if house prices struggle for a few years, you can still earn a very good return on your rent.

Calculating Rental Return

Very simple: First, calculate the annual net rental income and then divide it by your total investment in the property.

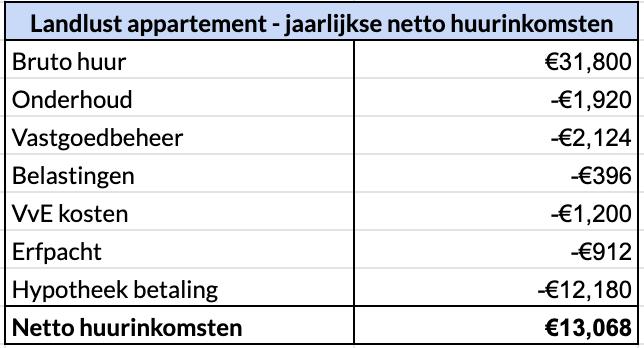

Annual net rental income:

The gross rent you receive each month from your tenants minus all costs such as mortgage interest, maintenance costs, insurance, possible VVE contributions, or ground lease.

Net rental return:

To convert this into a return, we compare these net income figures with the total amount invested in the property.

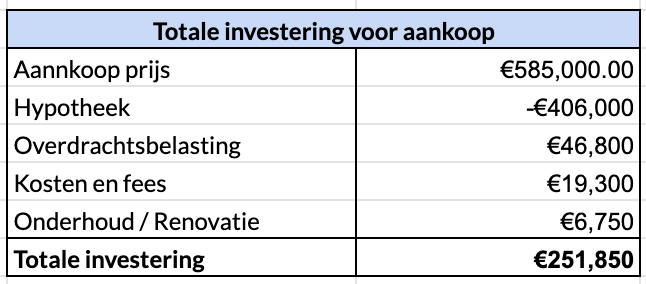

Total invested amount:

This results in a net annual rental return of 5.2% (= 13,068 / 251,850).

What is the average rental return?

It’s important to first distinguish between Gross and Net, as you often encounter gross returns, which can be much higher because they look at the gross rent (before deducting costs) and your equity in the apartment (not the costs incurred for transfer tax and notary). Gross return can be a quick way to compare properties, but ultimately, the net return is what you can effectively expect.

A good net rental return can depend on the location. For example, in a large city like Amsterdam, where the risk of vacancy is lower, a good return might be between 3-4%, whereas a good return in a smaller municipality like Assen is better around 6%.

Return from House Prices

You can estimate the rental return relatively well, but that’s not the case with the future housing market. Where prices will go in the next 10 years, nobody knows exactly?

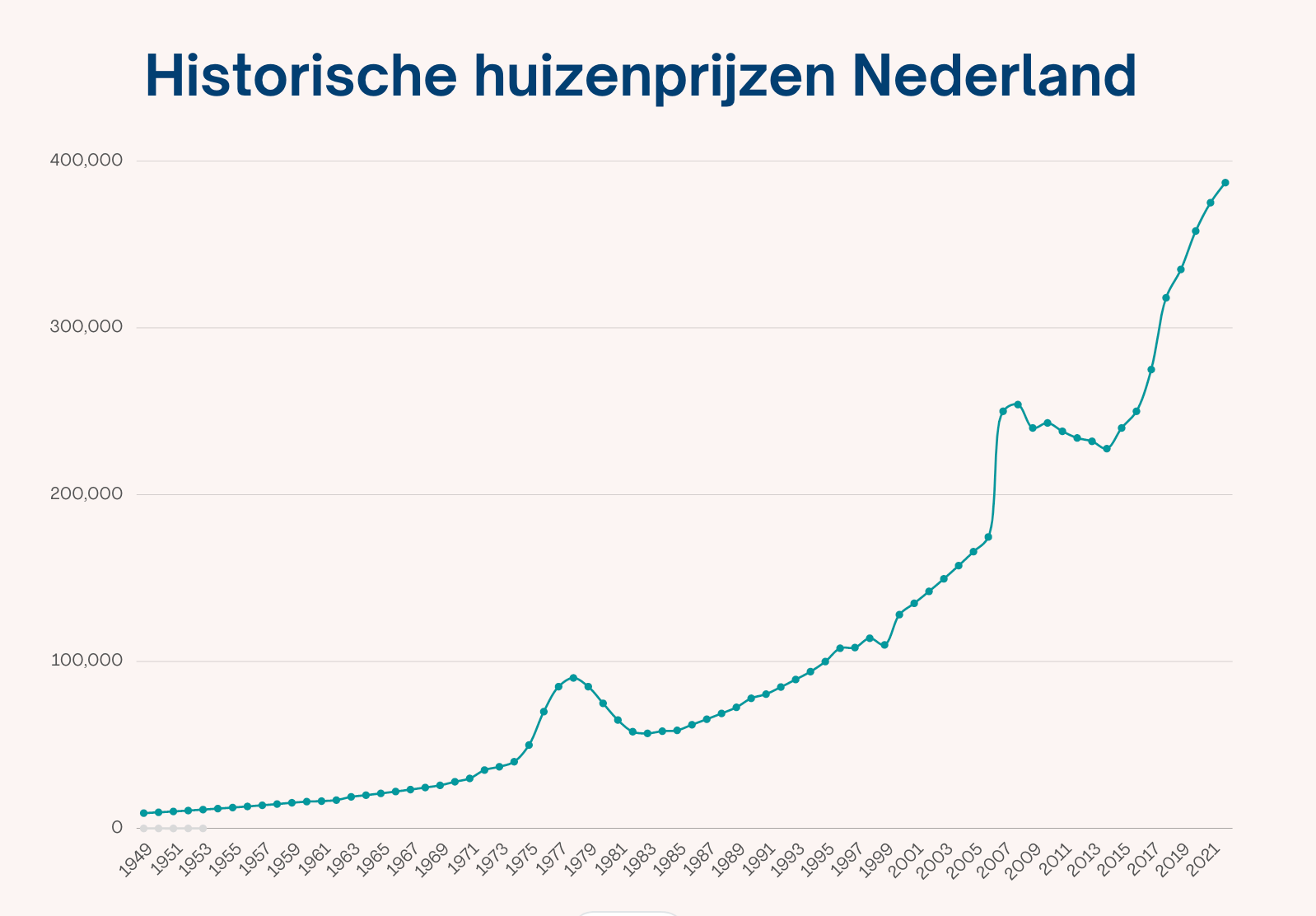

Let’s look at the historical housing market in the Netherlands: In 1949, the average price of a home was €9,199, and today it’s €387,000. This seems like a huge difference, but when calculated, it comes down to an average increase of 5.4% per year. We can therefore state that real estate increases in value over the long term.

The housing market is also more stable than the stock market, yet prices don’t rise equally strongly every year, and there are also years with price declines, such as in 1978 and 2008. You can read more about the current housing market and forecasts here.

Today, the housing market still seems strong due to a housing supply that doesn’t keep up with demand and many trends such as a strongly growing population due to migration to cities, inflow of expats, and shrinking households. However, it’s important to remain vigilant, and the same principle applies to real estate as to investing in the stock market: you cannot predict the future, and periods of price decline can always occur. So, it’s better to invest for the long term and not invest money you cannot afford to lose.

Chart Historical Housing Market in the Netherlands

Chart Historical Housing Market in the Netherlands

Comparison with Other Investments

If we add both returns, rental income (4-6%) and value appreciation (5.4%), we arrive at an average total return of between 9-12%. Depending on which stock market or index we look at, the average is somewhere between 8-10% over the past 30 years.

How do you choose between the two? Both have their advantages; stocks are very easy to buy and sell, and you can start with small amounts. Real estate, on the other hand, provides stable passive income through rent, is very tangible, and less volatile. The best choice is probably to diversify your portfolio and spread your investment between both.

How to start investing in real estate?

Real estate is a good investment that can help build passive income but is often considered inaccessible and only for wealthy investors (incorrectly!!). There are many ways to start investing in real estate with little money. With BRXS, you can invest directly in investment properties of your choice starting from €100. You also earn rental income and receive a detailed overview of your investments every three months, allowing you to learn as you go.

Whatever you do, hopefully, this is the beginning of your real estate portfolio.