If you’re looking for a guide on how to start investing in real estate, you’ve come to the right place. Real estate has been a very popular investment for many decades because it can help you build a passive income that lasts for the rest of your life.

And if you have no idea how to start with real estate, you’re certainly not alone. It’s not as simple as other more passive forms of investing, like buying an index tracker, for example.

But don’t worry, starting with real estate investing is possible for everyone!

Now, you won’t become a major landlord like Prince Bernhard of Orange Nassau, who owns and rents out more than 100 investment properties in Amsterdam, overnight. But even if you start small, show discipline and determination, and are willing to keep learning, you will definitely reap the benefits and build a strong financial future.

In this article about investing in real estate for beginners, we provide a comprehensive overview of what investing in property entails, how it can contribute to achieving your financial goals, what the different possibilities are, and how you can start step-by-step, even with little money.

- What is investing in real estate?

- Why invest in real estate?

- Risks in real estate?

- How to start investing in real estate?

What is investing in real estate?

Investing in real estate means putting your money into property, i.e., a piece of land and/or everything permanently attached to it (non-movable objects). Examples include: houses, apartments, commercial properties, data centers, factories, forests, agricultural land, logistics centers, and even wind turbines. Just like with other types of investments, as an investor, you hope to make a profit and earn money from your investment.

How do you make money with real estate?

Property is nothing new, and the ways to make money from it are still the same as 100 years ago. This also makes it reliable, and we can look far back into the past to examine the data.

Return from rental income

Very simple: the rent you receive each month from your tenants. However, you must consider that you will also have some costs, such as interest and repayment of your mortgage, maintenance costs, possible VVE (Homeowners Association) contributions, or ground lease. So, your net rental income (Rental income minus all costs) is what you can consider your return.

This rental income can be seen as passive income because it is typically very stable and predictable: the same amount is deposited into your account each month. Real estate is therefore a very good way to generate extra income outside of your job or other professional activities.

What is a good net rental yield?

Your rental yield heavily depends on how you calculate it: do you look at the gross rent (before all costs) or the net rent (after all costs)? It also depends on numerous other factors such as financing (loan-to-value), mortgage interest rate, and all estimated costs. Therefore, before purchasing an investment property, it’s important to map out the rental income and all costs and do the math.

How to calculate the return: Annual net rental income divided by your total investment in the property. You definitely want this to be above 3%, and preferably between 4-6%.

Return from appreciation

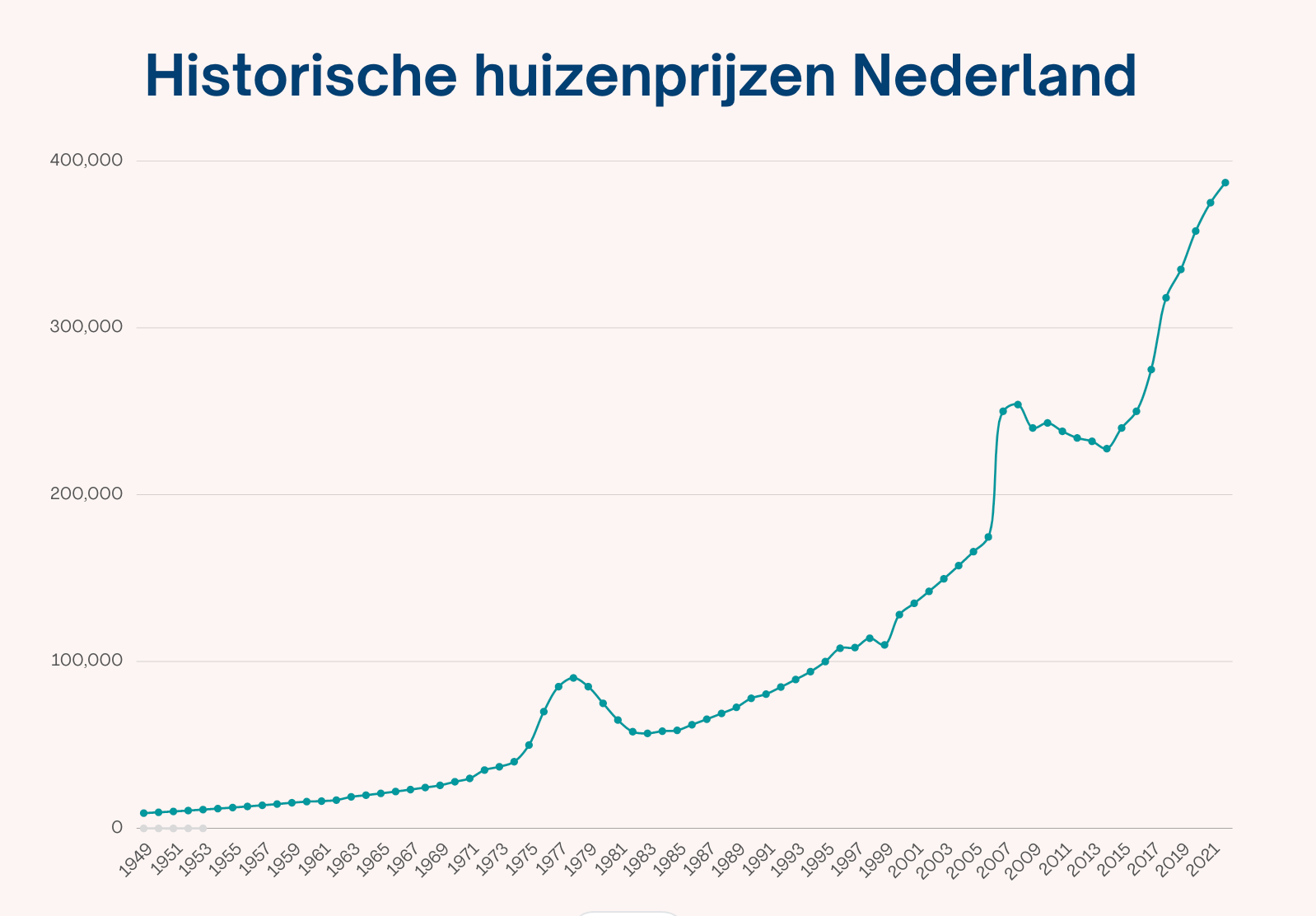

By looking at the development of house prices over the last 70 years, it will immediately become clear that real estate increases in value over the long term. In 1949, the average price of a home was €9,199, and today it stands at €387,000. This seems like an enormous difference, but when calculated, it amounts to an average increase of 5.4% per year.

Chart Historical development of house prices in the Netherlands

Chart Historical development of house prices in the Netherlands

Despite the housing market being much less volatile than the stock market, the graph above clearly shows that prices do not rise equally strongly every year and that there are even periods of price declines. In 1978, there was a serious crash that bottomed out in 1983, and in 2008, there was the credit crisis. This forced banks to impose much stricter criteria for granting new mortgages, causing demand to collapse and prices to fall over a period of 5 years until a bottom was finally reached in 2013.

You can find more info about the current housing market and forecasts here

Despite current prices, the housing market still appears strong due to a housing supply that cannot keep up with demand. Especially in urban areas where trends like a strongly growing population due to migration to cities, influx of expats, and shrinking households (meaning the same number of homes serves fewer people) continue. However, it’s important to remain vigilant, and the same principle applies to real estate as to investing in the stock market: you cannot predict the future, and periods of price decline can always occur. So, it’s better to invest for the long term and not invest money you cannot afford to lose.

Why invest in real estate?

Historically, real estate is one of the most reliable ways to build wealth. And it is still considered a smart investment by most millionaires today. And there are more reasons for this than just the return via rental income and appreciation:

Diversification

Don’t put all your eggs in one basket because investments involve risks. So if one basket takes a hard hit, your other baskets can protect you from heavy losses. Real estate can bring significant diversification to your portfolio because it shows little direct correlation with stock markets. In other words: stocks and real estate do not necessarily go up and down together in the same period.

Low volatility

If you own crypto, you certainly know volatility: prices that can rise by 20-30% one day and fall by 20-30% the next. Stocks are slightly less volatile than crypto but still experience intense periods, which can be quite exhausting and stressful if you follow your portfolio daily. Real estate, on the other hand, has historically shown lower volatility and brings more stability to your portfolio.

Leverage effect

If you purchase an investment property, you can relatively easily obtain a mortgage from your bank. This mortgage creates a leverage effect because you don’t just use your own capital to buy the property. The profits you make are generated with less personal investment, thus yielding a higher return on that investment.

Inflation hedge

Of all types of investments, real estate is the most correlated with inflation. When prices rise, the value of homes and rental prices often rise as well. Most rental contracts allow for an annual increase to follow inflation, causing your rental income to move upwards and providing protection against inflation.

Risks of real estate

As with all investments, real estate also involves risks:

- Maintenance costs: Unexpected repairs can always occur that cost much more than anticipated. This can never be ruled out, but conduct a good technical inspection before purchase to avoid surprises.

- Vacancy: You might not find a tenant for an extended period, which can reduce your rental income. Look for neighborhoods with a strong and stable rental market, such as cities.

- Housing market: House prices have seen sharp increases due to growing demand amidst a structural shortage of homes. But the past offers no guarantee for the future, and there have been several periods over the last 70 years when house prices fell.

- Non-paying tenants: If your tenant stops paying rent, you will need to start proceedings to terminate the lease agreement. This costs time and money. Be selective in choosing your tenants and work with an experienced property manager.

To reduce risks, it’s good to follow these principles:

- Diversify your portfolio so you can spread your risk and are not exposed to just one or a few investments.

- Invest with a long-term perspective, as this helps mitigate the temporary impact of periods with price declines. Short-term investing is not suitable for real estate.

How to start investing in real estate?

There isn’t just one way, but several ways to invest in real estate. Each method is different and has its pros and cons, so it’s good to read carefully and see which method suits you best.

You also don’t have to stick to one method; you can try a few or start somewhere and gradually try other methods.

1. Investment properties

The traditional way to invest in real estate is to do it yourself: buy a house to rent out.

How to make money with an investment property:

- Monthly rental income (ensure your expected rent is higher than your monthly expenses)

- Appreciation (you only realize this in the long term when you sell the property)

Advantages of buying an investment property:

- You have full control over what you invest in

- Passive income from rent can be a significant extra monthly amount

- Appreciation and equity can later allow you to get mortgages to buy new investment properties.

Disadvantages of buying an investment property:

- Requires a lot of money: Depending on the mortgage, you will still need to contribute a fair amount of equity

- Little diversification: putting a large amount into one property can be quite risky.

- Requires a lot of effort and time: finding, buying, maintaining, and managing an investment property can take up a lot of time and is not without obstacles.

2. Funds / REITs

These are funds that own and operate a whole collection of real estate, ranging from residential properties like rental homes and apartment buildings to office spaces, supermarkets, and much more. Some of these funds are private and less accessible for investment, often requiring a higher minimum deposit, but many other funds (also called REITs) are publicly traded on stock exchanges and are very accessible.

How to make money with a REIT:

- Dividend payments from the fund’s profits

- Selling your shares in the fund for a higher value

Advantages of a REIT:

- Very accessible: REITs are traded the same way as stocks

- No effort and work: you don’t have to do anything

- Very liquid: you can easily buy and sell your shares when needed

Disadvantages of a REIT:

- Little diversification because REITs tend to follow stock markets closely

- No control and transparency: You have no control over where the REIT invests, little transparency about what you actually own, so you’re not really involved.

- Very hands-off: feels more like investing in stocks

3. Real estate crowdfunding

Crowdfunding brings investors together with developers who want to finance their projects, and investors lend their money to those developers. The platform is often just an intermediary and receives a fee for facilitating payments between investors and developers.

How to make money with crowdfunding:

- In exchange for the loan, you receive periodic interest payments

- In some projects, you can also share in the profits (or losses).

Advantages of crowdfunding:

- Democratization: you have access and can often invest with smaller amounts

- You have control to decide what you want to invest in.

- High promised returns (sometimes well above 10% per year)

Disadvantages of crowdfunding:

- Transparency: Platforms have little responsibility, and it’s not always clear what your rights are if something goes wrong.

- High Risk: when investing in real estate projects like new developments or renovations, the timeline and feasibility of the project can change very often and negatively impact your return. Be vigilant and do your research.

4. BRXS

We started BRXS because we couldn’t find ourselves in any of the above options. Investing in our own investment property seemed the most attractive, but we simply didn’t have the money or the time to do it.

With BRXS, you can invest directly in investment properties starting from €100. Just as if you were buying an entire property yourself, you earn passive income through rent and potential appreciation over the longer term. You can build your own real estate portfolio without all the hassle of being the landlord, but with the benefits.

→ Read more about how to start with BRXS

Earn rental income

Every three months, net rental income is paid out to all investors, along with potential future appreciation in the long term.

No hassle

You can invest in minutes without much effort and don’t have to worry about managing the investment property. BRXS takes care of maintenance and management.

Start from €100

You can start with a small deposit: invest in what suits you, learn by doing, and gradually build your portfolio.

Full transparency

Before you invest, you can view all information and expected returns of the property. Once you own a BRXS note in a property, you receive a complete overview of all income and the status of your investment every three months.

Diversification across multiple properties

Our platform offers multiple investment properties you can invest in. This allows you to spread your investment and not have everything in one property.

What are the risks?

Although we started BRXS to make real estate investing more accessible, attractive, and transparent, it’s important to understand that all BRXS investments still carry risks, just like all other forms of investing. Your return is variable and depends on various factors such as house prices or property-specific events like tenant non-payment or unexpected maintenance.

Summary

Real estate is a good investment but is often (wrongly!!) considered inaccessible and only for wealthy investors. We hope this article on investing in real estate for beginners has not only shown you what real estate can contribute to your portfolio but also how you can get started. And you can certainly start with small steps and little money. You learn by doing, and hopefully, in the long run, you build a nice collection of real estate investments.