Buying investment properties is one of the most popular ways to invest in real estate. It allows you to build a passive income and also benefit from long-term increases in the housing market. You can then reinvest those profits into more investment properties, gradually building wealth. And there are many other advantages to investing in an investment property.

However, many mistakenly think that buying investment properties is only for the rich or that it’s better to start later in life. In this article, we want to debunk these myths and delve deeper into all aspects:

- Why buy investment properties as an investment?

- With the recent cooling in the housing market, is now a good time to buy an investment property?

- How to buy an investment property? Where are investment properties for sale?

- How can you buy properties with little money?

Why buy an investment property?

Buying investment properties has long been considered one of the most reliable ways to build wealth. And even today, it is still seen as a smart investment by most millionaires. There are, of course, many reasons for this, but let’s first look at how you actually make money from it.

Earning in 2 independent ways

When buying an investment property, you need to consider two different types of return: 1) The rent you receive from your tenants. Of course, you also need to account for all your costs, so it’s better to consider your net rent. 2) The appreciation of your property over the long term.

Both returns are also very different. Rent is cash flow, a fixed amount deposited into your account each month. You can also see rent as passive income. Whereas appreciation is a profit you only realize when you eventually sell your investment property.

Both incomes are independent of each other and thus also provide good diversification, even in difficult times. For example, if the housing market is not doing so well and house prices are not rising or even falling for a period, you still earn money from rental income.

Mortgage Effect

When buying your property, you can partially finance it with an investment mortgage. You don’t have to put down all your own money, and this loan provides a leverage effect. Because the profits you earn are made with a lower personal investment, your return on that investment is much higher.

Inflation protection

Real estate is strongly correlated with inflation. This means that when prices rise, rental prices often rise too. Most rental agreements allow for an annual indexation to increase with inflation, so your return increases along with inflation.

Stability

If you have already invested in bitcoins or other cryptocurrencies, you are certainly aware of what volatility is. Stocks are less volatile, but can still fluctuate quite a bit daily. Buying an investment property, on the other hand, is much less volatile in terms of return and therefore brings more stability to your portfolio.

Portfolio diversification

Don’t put all your eggs in one basket, because investments carry a certain risk. So if one basket is hit hard, your other baskets can protect you from major losses. Buying an investment property, in particular, can bring a lot of diversification because it has a low correlation with the stock markets. In other words, stocks and real estate do not necessarily move up and down together in the same period.

Housing market: Is now a good time to buy?

You can predict the return on your rent fairly well if you do a thorough analysis of current rental prices and estimated costs for maintenance and mortgage payments. But no one can predict future house prices.

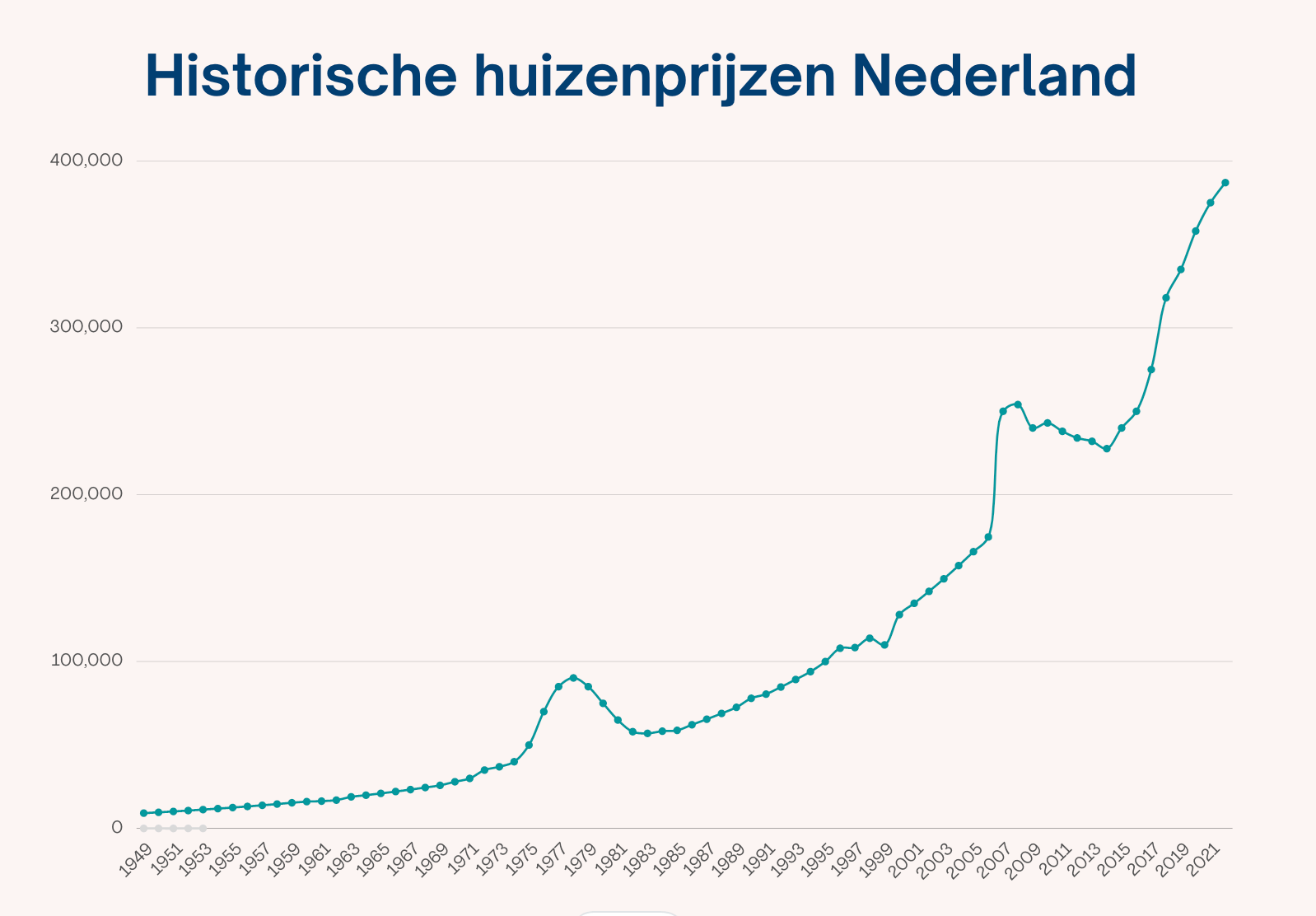

You can look at the past: in 1949, the price of an average home was around €9,000, and today it’s about €390,000. That seems like a huge difference, but it amounts to an annual increase of about 5.4%. This is an average, or in other words, if prices had risen at the same percentage each year between then and now. The reality, of course, is that in some years prices rose much faster, and in other years there were also declines in the housing market, such as in 1978 and 2008.

Graph Historical development of house prices in the Netherlands since 1949

Graph Historical development of house prices in the Netherlands since 1949

Current state of affairs:

In the 3rd quarter of 2022, there was an average annual price increase of 2%, but also a decrease of 5.8% compared to the second quarter. The reason is, of course, the declining demand due to higher mortgage rates, inflation, and soaring energy prices weighing on budgets. It’s very difficult to estimate what the next few years will bring, and for this, you can look at both supply and demand.

- Demand: Depending on how mortgage rates and purchasing power continue to evolve over the coming months, demand is likely to stabilize or even decrease, and the frenzy of recent years will subside. Under current circumstances, people simply cannot borrow as much.

- Supply: There is still a huge shortage of more than 300,000 homes in the Netherlands. To close this gap, the Ministry of the Interior aims to increase the current pace of 70,000 new homes per year to 100,000 new homes. Even if this target is met (which will certainly not be easy), the housing shortage will not be eliminated before 2030.

Bring supply and demand together, and the real estate experts at the banks are divided for 2023: some anticipate slight growth (Rabobank at 3%), while others expect a slight decline (ABN Amro at -2.5%).

How does this impact the purchase of an investment property?

Of course, it’s good to consider the economic situation and the current state of the housing market, but it’s also good to keep two principles in mind:

- No one knows exactly what the near future holds, and trying to time the market is essentially gambling. But if we look historically at the long term, real estate has always steadily trended upwards. Look at the graph above between 2012 and 2014 (2 years), the housing market went down, but between 2012 and 2022 (10 years), the market rose enormously. That’s why investing is something you do with a long-term perspective.

- When you buy an investment property, you invest in that specific property, not the entire housing market. Just like in the stock markets, not every property is an attractive investment property within real estate. As an investor, you must be very selective in your search for your property.

- Attractive segments: By this, we don’t mean a mansion on the Keizersgracht (this could actually be a bad investment), but looking within sectors where there is a pressing shortage, high demand, or under-investment. For example, student housing: There is a huge shortage of student rooms in the Netherlands. The situation has become so severe that many Dutch universities have advised students not to come to the Netherlands this academic year.

- Focus on high rental yield: With an investment property, you have two ways of earning: Rent and appreciation. By investing in a property with a strong and stable rental yield, you ensure good diversification. Even if the housing market performs less well for a period, you… ## What to consider

Transfer tax

When buying an investment property, you pay transfer tax at the time of purchase, which is 8% of the property’s value, much higher than when buying a home to live in. This tax will increase slightly to 10.4% in 2023. You do not pay tax on renting out the property, and your rental income does not need to be declared, but your apartment does count towards your assets (in box 3), and depending on your situation, you do pay taxes on this.

Owner-occupancy obligation

Many cities have recently introduced an owner-occupancy obligation. This means that upon purchasing a property, you as the buyer are obliged to live in the property yourself for several years and cannot rent it out. So, check the rules carefully in the city where you might want to buy an investment property.

Return-enhancing factors

With high property prices and rising mortgage rates, achieving a good return is becoming more difficult. However, there are still opportunities in specific segments such as room rentals, co-living, and student rooms, which often offer higher returns. These are not easy to find, but we have a few available on our platform.

Liquidity

Buying an investment property is not a good investment for short-term speculation. If you decide to go for it, do so with a long-term perspective. This will benefit your returns, and your investment will also be less sensitive to potential fluctuations in house prices if things go less well for a few years.

Social housing vs Free sector housing

Your property can fall into either the social or the free sector. For a property in the social sector, there is a maximum rental price, which in 2022 is €763.47; whereas, for a free sector property, you can determine the rental price yourself, and there is no maximum upper limit.

Which sector your rental property falls into depends on a points system based on criteria such as surface area, WOZ value, or whether it’s a monument. Check and confirm that the investment property you are interested in scores above 142 points so that you can set the rent yourself; otherwise, your investment might not be profitable. It’s even advisable to aim a bit higher just in case the points system is adjusted in the future.

Property management

At first glance, a professional property manager might seem expensive, and doing everything yourself might seem like a good alternative. However, you’ll quickly find that a property manager can save you a lot of time, effort, and even money because they know the market very well, can determine the ideal rent, help select reliable tenants, and provide good advice on maintenance and renovations.

Buying an investment property with little money

Let’s take a classic example: Suppose you’ve set your sights on an interesting investment property for sale at €400K, and the bank gives you an investment mortgage for €320K. You still need €100K of your own money (especially when you add all costs like transfer tax and notary fees). €100K is not nothing, and not many people have that lying around or want to put all their savings into one property. Therefore, we look at several ways you can invest directly in properties with much less money.

1. Invest using your home equity

If you already own your own home, you can use the equity in your house to finance your investment property. This equity can be used as collateral with your bank to take out an additional loan, which you can use to further finance your investment in an investment property (beyond the mortgage on your property). Depending on how much extra you can borrow, you might not even need any other contribution. It’s good to get advice from a financial advisor or your mortgage provider to see what the options are without taking too much risk.

2. Take out a personal loan

If you don’t have enough money for the equity, you can also look for alternative loans or seek the money within your own circles (family, friends, business partners). Here, it’s important to understand the conditions well and not take unnecessary risks. The more you borrow, the higher your monthly costs will be, and you need to ensure you have enough monthly rental income to cover those burdens. So, this is only an option if the interest rate is attractive and the math adds up; do a thorough analysis before you start.

3. Invest together with friends

You can buy the investment property together with friends or family, and then share the rental income, costs, and appreciation. Here, you need to make good agreements and preferably put much of it in writing contractually, because what seems like a good idea today can turn out very differently if everyone has different ambitions in a few years.

4. Buy a garage box

Because prices are much lower than all other types of real estate, garage boxes have become a very popular alternative. You can find them starting from €15,000. The location is crucial as this will determine your return. So, do thorough research into the rental market for garage boxes to see if demand exists and what rent you can realistically charge.

5. Crowdfunding

Crowdfunding gives you, as an investor, quick access to interesting projects where you have the choice to decide what you invest in. Often, you can invest starting from small amounts, and the “promised” returns are attractive (sometimes even well above 10% per year) because the real estate developers cannot get traditional financing for their project.

Here, you need to be cautious because some projects involve high risk. Especially if they are new developments or complex renovations. Such projects often experience delays, can lose permits, or are sometimes never completed, which can lead to significant losses.

6. BRXS

We started BRXS because the options above didn’t work for us. We were looking for a way to lower the barriers to buying investment properties while still being able to invest directly. On our platform, you can invest directly in the investment properties you like (from €100 up to €10,000 per property). This way, you can easily build a real estate portfolio, diversify, earn passive income from rental income (paid out quarterly), and also benefit from long-term appreciation.

→ Create a free account and view the available investment properties](https://app.brxs.com/)

Conclusion

Buying investment properties is a good way to make your money work for you and build wealth. Unfortunately, it is often wrongly considered something only for the “rich and famous”. Hopefully, you now have a better idea of how you can start investing in investment properties, even with little money. Feel free to email us at hello@brxs.com with questions or comments, and if you want to talk to us about how to get started with BRXS, you can also schedule a call.